Tesla Stock May Be Rallying For This Absurd Reason — And This Won’t End Well

From nearly bankrupt to the world’s most valuable company. In a day

In 2008, Volkswagen (VOW) was barely holding up. One of Germany’s largest automakers was head over heels in debt. And as the Great Recession swept the world, its auto sales crashed to the ground. But then something unexpected happened.

On October 26, 2018, out of the blue, Volkswagen stock shot up a jaw-dropping 82%—briefly becoming the world’s most valuable company. Later it crashed 95% and never recovered, wiping out most investors in the process.

What happened here was a market phenomenon called a “short squeeze.” And as I’ll explain, the same thing—just in bigger proportions—is at play with Tesla

In plain English, here’s what a “short squeeze” is

Say you’ve got a $1,500 balance at Robinhood, or any other broker. And you want to bet against stock X whose price is $1,000.

You “sell” the stock by borrowing a share worth $1,000 from your broker. Now, there are two scenarios: the stock goes up or the stock goes down.

Trump Wants To Block Funding For Virus Testing, CDC In Next Stimulus Package

Trump has called for the U.S. to scale back testing, going so far as to say... →

If the stock goes down, you return the share at a lower price and cash in the difference. But if the stock goes up, you have to buy the share and return it to the broker—no matter the price.

In the latter scenario, your downside is unlimited. And the broker wants to be sure you’ve got the money to return the share.

So if you have $1,500 in your balance and the price of X hits, say, $1,500, the broker will ask you to deposit more money (or add margin to your account). If you don’t have the money, the broker will force you to buy and return the share at $1,500.

Problems begin when this happens on a bigger scale. You see, when lots of short sellers are forced to exit the trade and buy the stock all at once, the puffed up demand pushes the stock price up.

The higher stock price wipes out even more short sellers, which in turn drives the stock price even higher. This repeats again and again, sending the stock price to bananas levels. And this vicious cycle is what we call a “short squeeze.”

Tesla is America’s most hated (shorted) stock

Tesla is now the most valuable car company in the world. The stock is worth more than triple the combined value of US automakers General Motors (GM

No surprise Tesla has lured in a record number of investors who are betting against it—making it America’s most shorted stock. But what's really surprising here is the scale.

The dollar value of all shorted Tesla shares is close to hitting $20 billion. No US stock in history has ever been that shorted.

For perspective, Apple

The sheer magnitude of short sellers put Tesla at risk of being caught in a short squeeze of historic proportions. And one likely was triggered at the end of last year.

Short sellers have been buying Tesla stock en masse

On October 23 2019, Tesla reported a profitable quarter, blowing away analysts who expected losses. In the next two days, Tesla stock popped 31%—which likely triggered a chain of short squeezes that exist to this day.

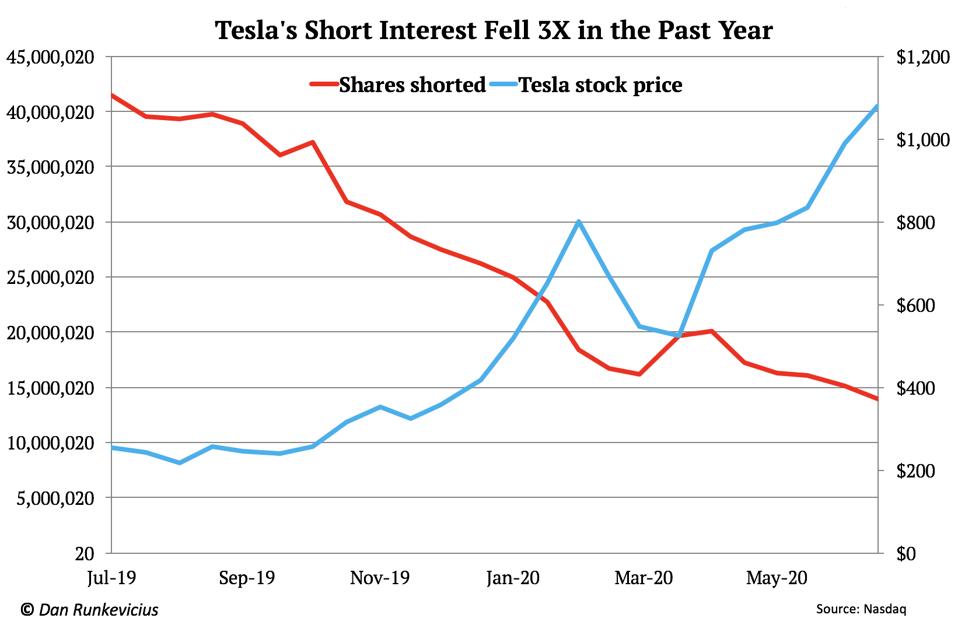

Look at the chart below (and take a careful look because it may be the most important chart about Tesla right now). It shows how the number of shorted Tesla shares fell off the cliff as Tesla stock was roaring higher:

Tesla's short interest fell three times as Tesla stock soared

While Tesla stock soared 340% in the past year, its short interest fell three times. That means short sellers were forced to buy tens of millions of Tesla shares during this past year—and that surely played a part in Tesla’s historic rally.

You don’t have to work on Wall Street to understand this

Stock prices come down to supply and demand. If there are more buyers than sellers, the stock price rises. And vice versa.

So let’s run the numbers. Short sellers were forced to buy ~38 million shares over the past year. That’s 20% of all Tesla shares available to the public.

Sovereign Creditors Must Not Rewrite the Rules During the Pandemic

NEW YORK – In the wake of COVID-19, there is an urgent need for sovereign d... →

Which is a lot, but by itself wouldn't move the stock to such highs. You need much bigger demand.

Another suspect for bidding up Tesla stock is institutional investors. These are the heavyweights of the market: investment banks, pension funds, hedge funds, insurance companies. They manage trillions of dollars and own ~80% of the entire stock market.

According to Nasdaq

According to Fidelity data, in Q4 2019 they bought only 1.8 million Tesla shares net. During that time, short sellers bought nearly 10 million shares—fives time more than the market’s biggest buyer.

In Q1 2020, when Tesla soared 400%, institutional investors were offloading Tesla stock in droves. They sold 4.4 million shares. Meanwhile, according to Nasdaq, short sellers bought another 10 million shares.

So if it’s not short sellers (by themselves) and the heavyweights that are driving Tesla stock to the moon, who is?

Short sellers likely triggered mania

Tesla has long had the rep of a cult stock. But a chain of short squeezes could have turned it into outright mania.

Think about it, Tesla comes out with great news. The stock budges higher than expected. Caught in a short squeeze, short sellers buy the stock in bulk, driving it up by double digits. Minds are blown. Tesla is all over the news, which leads to this:

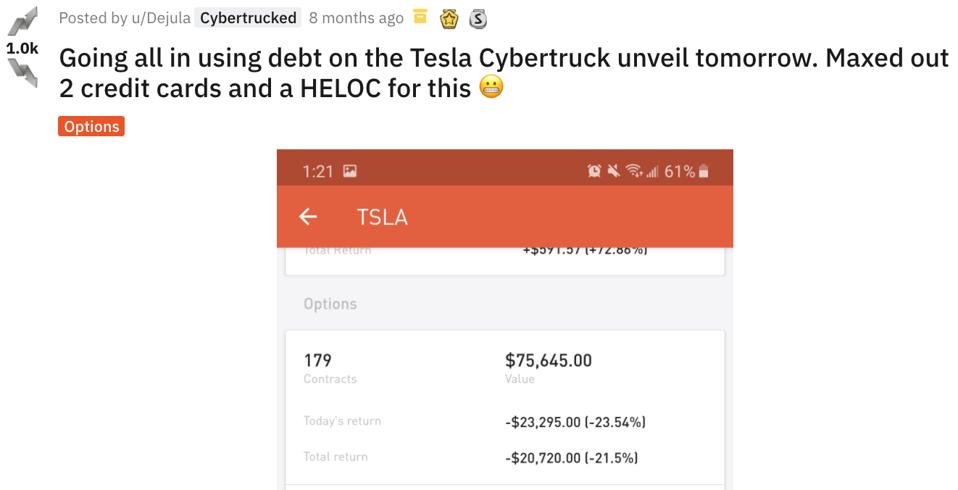

Reddit thread about Tesla (TSLA)

And this:

Reddit thread about Tesla (TSLA)

In other words, a tsunami wave of individual investors pile in, pushing the stock even higher. Short sellers are caught off guard again. The chain of short squeezes continues to propel Tesla’s price even higher.

Once again, Tesla is flashing all over the headlines further fueling the mania. Rinse and repeat.

But now that more and more short sellers are getting wiped out, Tesla’s short squeeze may be coming to an end. And without its biggest driver, Tesla stock may soon lose steam.

Still, I wouldn’t call this the top yet. Momentum is a powerful force that could last longer than sanity can hold out. Not to mention Tesla might soon be added to the S&P 500, yet another catalyst that could drive the stock even higher.